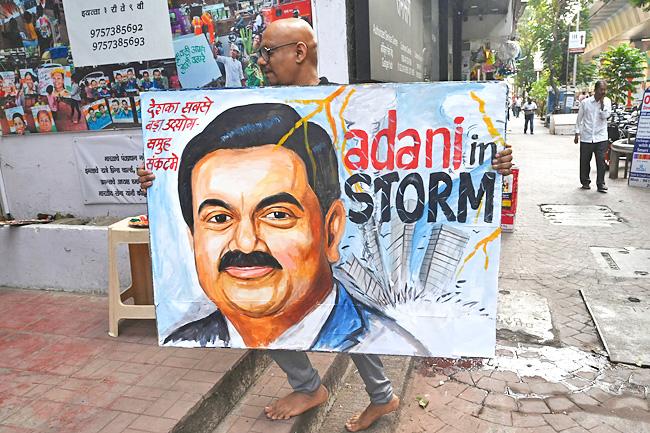

AFP – India’s securities regulator said on Saturday that markets were stable and protected from further volatility, following a phenomenal share rout that hit the business empire of tycoon Gautam Adani.

The combined market cap of Adani Group’s listed companies has collapsed by around USD120 billion – about half of the conglomerate’s value – since US short-seller Hindenburg Research released an explosive report in late January. It accused Adani of accounting fraud and artificially boosting its share prices, calling it a “brazen stock manipulation and accounting fraud scheme” and “the largest con in corporate history”.

The Securities and Exchange Board of India (SEBI) said in a statement that India’s financial market had “demonstrated ongoing stability and is continuing to function in a transparent, fair and efficient manner”.

It added that it had “put in place a set of well defined, publicly available surveillance measures” for addressing excessive volatility in specific stocks, without naming the Adani conglomerate. Adani dismissed the allegations in the Hindenburg report as a “maliciously mischievous” reputational attack and issued a 413-page statement asserting its claims were “nothing but a lie”.

Hindenburg said in response Adani had failed to answer most of the questions raised in its report.