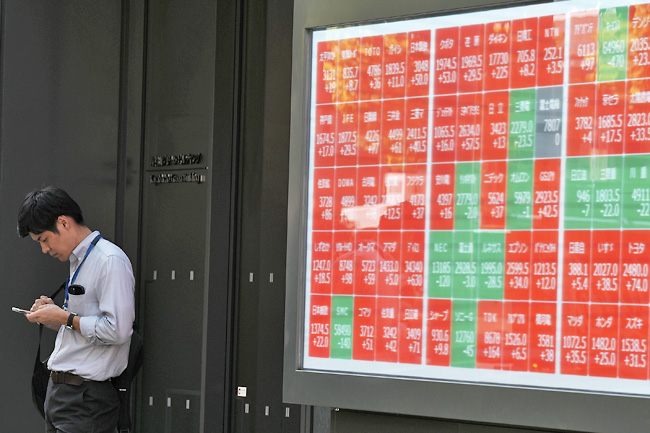

TOKYO (AP) – Global shares mostly declined yesterday as investors grappled with uncertainty ahead of the United States (US) election next Tuesday.

France’s CAC 40 slipped 0.7 per cent to 7,378.45 in early trading. Germany’s DAX fell 1.1 per cent to 19,257.34. Britain’s FTSE 100 declined 0.6 per cent to 8,114.02. US shares were set to drift lower with Dow futures down 0.5 per cent at 42,149.00, while S&P 500 futures slipped nearly 0.8 per cent to 5,807.50.

Japan’s benchmark Nikkei 225 dipped 0.5 per cent to finish at 39,081.25. Australia’s S&P/ASX 200 slipped 0.3 per cent to 8,160.00. Hong Kong’s Hang Seng lost 0.1 per cent to 20,359.95, while the Shanghai Composite added 0.4 per cent to 3,279.82.

South Korea’s Kospi dropped 1.5 per cent to 2,556.15 after North Korea test launched a new intercontinental ballistic missile designed to be able to hit the US mainland in a move that was likely meant to grab America’s attention ahead of Election Day.

Markets also were watching the Bank of Japan, which kept its benchmark rate unchanged at 0.25 per cent. Japan is also facing political uncertainty after its governing party, tainted by campaign financing scandals, lost its majority in the Lower House of Parliament in elections last weekend.

Upcoming earnings releases in Asia, as well as the rest of the world, also added to the wait-and-see mood.

A US report on Wednesday suggested employers outside the government accelerated their hiring in October, when economists were forecasting a slowdown. It could raise optimism for today’s more comprehensive jobs report coming from the US government.

A slowing economy is no surprise after the Federal Reserve (Fed) hiked interest rates sharply in hopes of braking the economy enough to get inflation under control. The question is whether the Fed can help keep the economy out of a recession, now that it’s begun cutting interest rates to keep the job market humming.

Traders are largely expecting the Fed to cut its federal funds rate by a quarter of a percentage point at its next meeting next week, according to data from CME Group.

In energy trading, benchmark US crude rose 18 cents to USD68.79 a barrel. Brent crude, the international standard, added 15 cents to USD72.70 a barrel.

In currency trading, the US dollar slipped to JPY152.14 from JPY153.31.

The euro cost USD1.0855, down from USD1.0858.