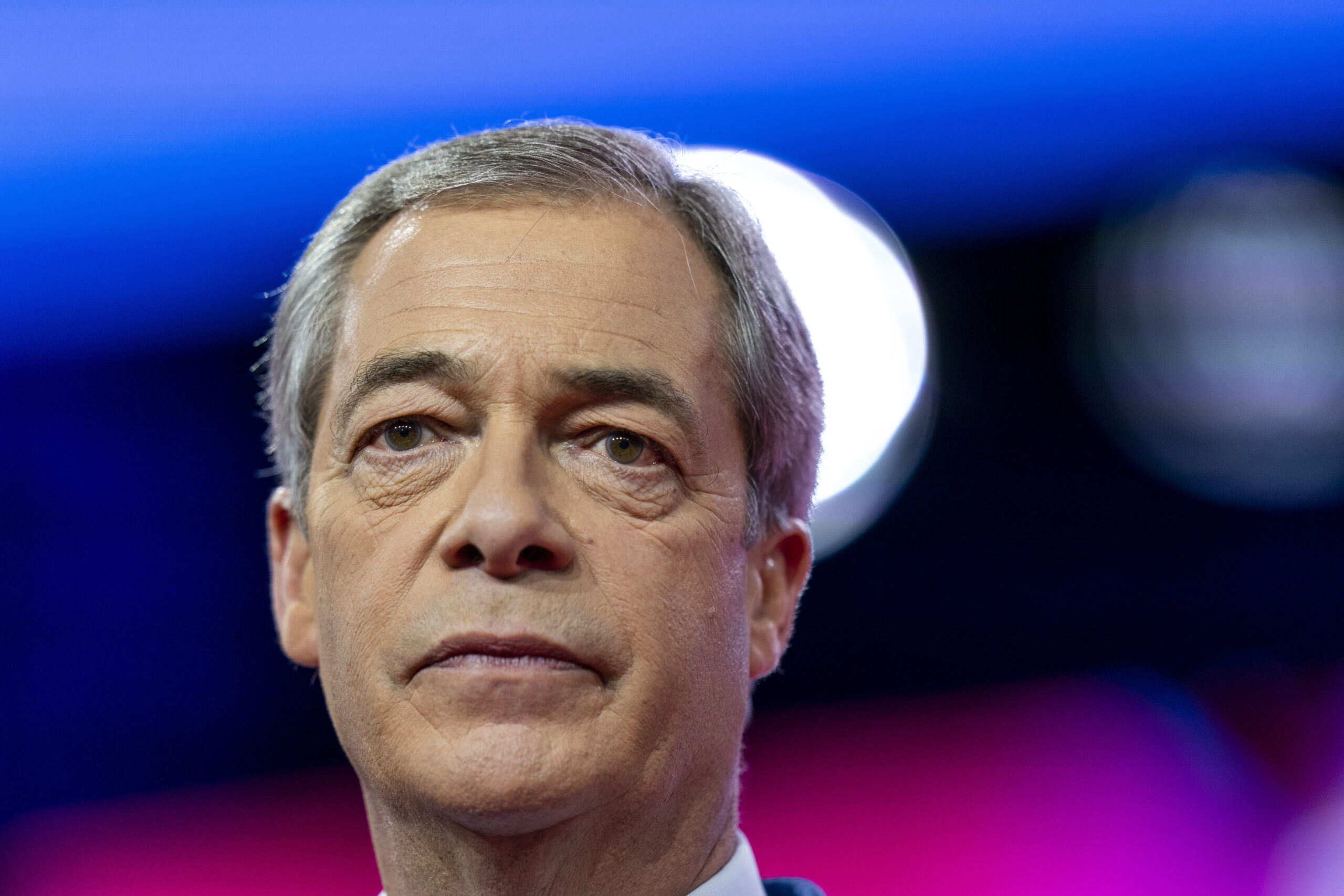

LONDON (AP) – The chief executive of United Kingdom (UK) bank NatWest Group apologised on Thursday to populist politician Nigel Farage after he complained that his bank account was shut down because the banking group didn’t agree with his political views.

Talk show presenter and former leader of the pro-Brexit UK Independence Party Farage said his account with the prestigious private bank Coutts, owned by NatWest Group, was closed down unfairly.

He shared documents he obtained from the bank with Mail Online, the Daily Mail tabloid’s online outlet, that allegedly showed bank officials writing that continuing to retain Farage as a customer would be incompatible with its “position as an inclusive organisation” given his publicly-held views.

The alleged bank documents said Farage was “seen as xenophobic and racist” and “considered by many to be a disingenuous grifter”. They said there was substantial “adverse press” associated with him and discussed the reputational risk to the bank by associating with him.

The documents have not been verified by The Associated Press (AP).

Chief Executive of NatWest Group Alison Rose wrote to Farage to apologise for “deeply inappropriate comments” made about him in the documents and said the bank has offered him alternative banking arrangements.

“It is not our policy to exit a customer on the basis of legally held political and personal views,” she said in a statement. “I fully understand the public concern that the processes for bank account closure are not sufficiently transparent… the experience of clients highlighted in recent days has shown we need act now to put our processes under scrutiny.”

Banks will have to explain why they are shutting down someone’s account under the new rules, and give 90 days’ notice for such account closures. They previously have not had to provide a rationale for doing so.

The changes are intended to boost transparency for customers, but will not take away a banking firm’s right to close accounts of people deemed to be a reputational or political risk.