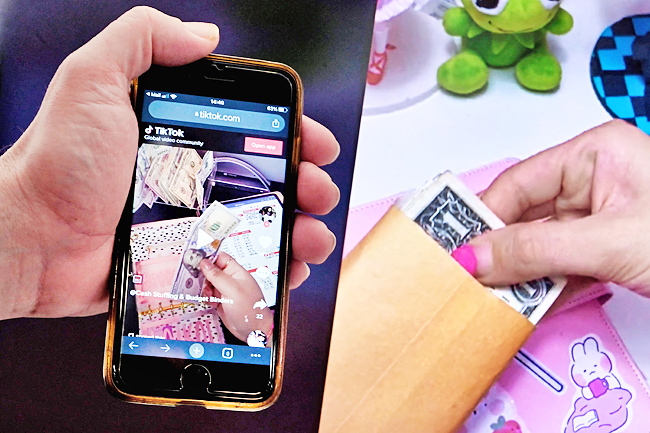

WASHINGTON (AFP) – Manicured fingers meticulously place cash in transparent envelopes marked “food,” “gas” and other categories, demonstrating in a TikTok video a retro technique for controlling what you spend that is newly popular with some money-conscious Americans.

Returning to cash to control spending may be old fashioned, but in an era of high inflation, a growing number of consumers find that it works.

Judia Griner, 25, started “cash stuffing” two years ago when she was a student at Old Dominion University in Virginia. Now, her TikTok account has more than 200,000 followers.

“I was like, I need to somehow use my own money to pay off the tuition so I won’t be in too much debt,” Griner told AFP.

“I realised that I had no idea how to do that, because I just didn’t know how much money I had,” she said.

“I would swipe my card, and I would just kind of cross my fingers and hope that it wouldn’t be declined.”

It was a similar situation for 31-year-old Jasmine Taylor, who launched her Tiktok channel in February 2021 and now has more than 620,000 followers. “I had a degree but no outlook for a job. My finances were bad,” Taylor, a Texan, said. “I was a pretty big impulse shopper.”

Both women decided the way to turn around their spending behaviour was to rely on the technique of paying cash for everything.

Once they cash in their pay checks, they separate it into different envelopes for specific expenses – rent, shopping, etc.

On TikTok, the hashtag #cashstuffing has now reached more than 930 million views.

The method is reminiscent of the age-old piggy bank system, and was popularised in its current form 20 years ago by financial guru Dave Ramsey, before the era of smartphones and contactless payments.

Despite being outdated and at times inconvenient – some businesses refuse to accept cash – the method has allowed Griner to save USD7,500 to finance her education.

“The card didn’t feel like real money to me,” Griner said.

But using cold cash made it very real.

“I could physically see myself spending all my cash and it just went away and that’s what helped me curb my spending,” she said.

Taylor, too, saw immediate results. She pays 95 per cent of her expenses in cash, got rid of USD32,000 in student debt, USD8,000 in credit card debt and USD5,000 in health care debt.

Wracking up debt is a national affliction in a country with abundant credit card offerings that goad households to take on more and more loans.

“It’s a problem that my generation kind of suffers from: consumerism and just overspending everything,” Griner said.