Aqilah Rahman

The global economy witnessed its largest crisis in over a century due to the pandemic.

Poverty rates have soared and economic activity lessened in 90 per cent of countries, more than during the Great Depression of the 1930s and the global financial crisis from 2007 to 2009, according to a report by The World Bank.

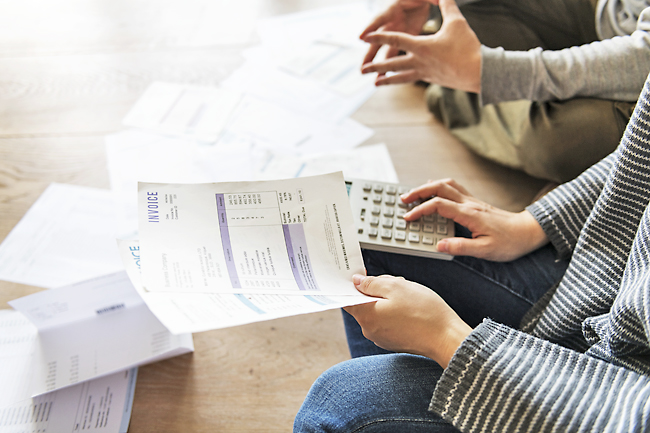

As a result, households and businesses may struggle to repay loans, find themselves insolvent or will have a hard time accessing credit in order to sustain themselves through the pandemic.

Excess levels of debt is an issue the World Development Report 2022 identifies as economic risk.

It also discussed areas where policymakers, especially those in developing countries, should look into to try and mitigate its effects.

One area the report suggested to address is what would happen when pandemic debt-relief

measures expires. For example, many countries have sought to ease debt burdens by offering a delay in repayments for loans.

However, the report said non-performing loans (NPLs) – failure to pay debt as scheduled for a period of time – is expected to increase across countries as governments wind down support policies for borrowers.

Loans to zombie firms – businesses that are unlikely to recover and pay off their debts – is also expected to increase.

In order to effectively manage NPLs, the report suggested improving transparency and supervision, resolving troubled loans through regulatory interventions, and deploying early intervention measures to turn around ailing banks and resolve failing ones.

LEGAL INSOLVENCY

The report also noted that many household and businesses struggle with unsustainable debts due to the pandemic.

Insolvency proceedings – a process taken when businesses or individuals are no longer able to meet their financial obligations and pay their debt – can help reduce excessive levels of debt.

However, a sudden increase in loan defaults – failure of debt payment for an extended period of time – and bankruptcies makes it challenging to resolve bankruptcies in a timely manner.

In order to ease debt distress and facilitate economic recovery, the report suggested the following reforms: strengthening formal insolvency mechanisms, facilitating alternative dispute resolution systems, establishing accessible in-court and out-of-court procedures for small businesses, and promoting debt forgiveness and long-term reputational protection for former debtors.

ACCESS TO FINANCE

Many households and small businesses are at risk of losing access to formal credit due to the pandemic. Uncertainty in economic recovery and financial health of applicants makes it challenging for financial institutions to assess risk and determine the suitability of an applicant in receiving loan.

Although deferring debt payment and freezing credit reports are important in managing the impacts of COVID-19, it is also more difficult for banks to distinguish applicants with temporary liquidity problems from those who are truly insolvent.

Meanwhile, credit risk of low-income households and small businesses is difficult to assess because they usually lack a credit history and audited financial statements.

The difficulty in assessment is further amplified by the disruption of business activity and livelihoods.

With the pandemic making it difficult to access the credit risk of potential borrowers, the report suggests mitigating the risk of NPLs with improvised visibility.

This includes using new data and technology to update existing risk models and increase visibility into a borrower’s ability to repay.

Other strategies include temporary reduction in loan tenors and leveraging digital channels to collect current transactional data.

SOVEREIGN DEBT

In addition to the three areas highlighted above, the pandemic has also led to a sharp increase in sovereign debt.

For low and middle-income countries, average total debt burdens rose by about nine percentage points of GDP during the first year of the pandemic, compared with an average increase of 1.9 percentage points over the previous decade.

Debt distress, defined as a country’s inability to fulfil its financial obligation, poses significant social costs.

While governments accumulated debt to finance current expenditures, spending on public goods such as education and public health was limited.

With governments often being the lender of last resort, the report highlighted that private sector debt can quickly become public debt in the case of economic crisis and need of public assistance.

The government’s investment in public goods, as well as its delivery of its role as the lender of last resort is crucial in managing sovereign debt.

Countries will have to prioritise the most important policy actions needed to tackle the

aforementioned areas.

Low-income countries may prioritise tackling unsustainable sovereign debt, while middle-income countries with corporate and household debt may focus on supporting financial stability.

Countries must also take into account factors such as fluctuating price of commodities, exchange rate and interest rate risks towards an equitable economic recovery.