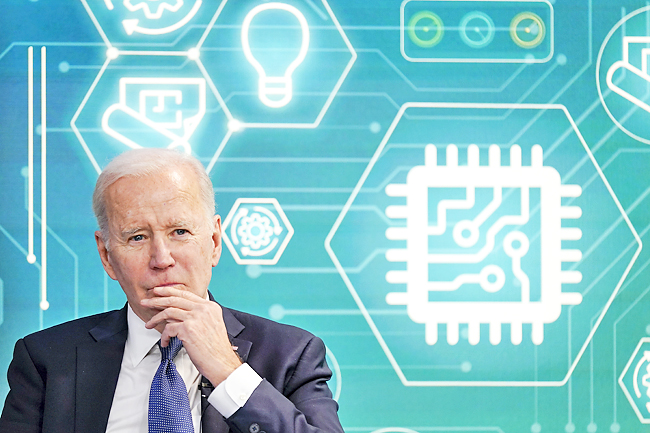

WASHINGTON (AP) – United States (US) President Joe Biden on Wednesday signed an executive order on government oversight of cryptocurrency that urges the Federal Reserve to explore whether the central bank should jump in and create its own digital currency.

Treasury Secretary Janet Yellen said the effort would “promote a fairer, more inclusive, and more efficient financial system” while countering illicit finance and preventing risks to financial stability and national security.

The Biden administration views the explosive popularity of cryptocurrency as an opportunity to examine the risks and benefits of digital assets, said a senior administration official who previewed the order on Tuesday on the condition of anonymity, terms set by the White House.

Under the executive order, Biden also directed the Treasury Department and other federal agencies to study the impact of cryptocurrency on financial stability and national security.

Brian Deese and Jake Sullivan, Biden’s top economic and national security advisers, respectively, said the order establishes the first comprehensive federal digital assets strategy for the US.

“That will help position the US to keep playing a leading role in the innovation and governance of the digital assets ecosystem at home and abroad, in a way that protects consumers, is consistent with our democratic values and advances US global competitiveness,” Deese and Sullivan said on Wednesday in a joint statement.

Last week, Democratic Senators Elizabeth Warren, Mark Warner, and Jack Reed asked the Treasury Department to provide information on how it intends to inhibit cryptocurrency use for sanctions evasion.

The Biden administration has argued that Russia won’t be able to make up for the loss of US and European business by turning to cryptocurrency. Officials said the Democratic president’s order had been in the works before Russia’s Vladimir Putin invaded Ukraine last month. A deputy national security and economic adviser to Biden Daleep Singh told CNN on Wednesday that “crypto’s really not a workaround for our sanctions”.

The executive order had been widely anticipated by the finance industry, crypto traders, speculators and lawmakers who have compared the cryptocurrency market to the Wild West. Despite the risks, the government said, surveys show that roughly 16 per cent of adult Americans – or 40 million people – have invested in cryptocurrencies.

As for the Federal Reserve getting involved with digital assets, the central bank issued a paper in January that said a digital currency “would best serve the needs” of the country through a model in which banks or payment firms create accounts or digital wallets.

Some participants in digital currency welcome the idea of more government involvement with crypto. CEO of Inca Digital, a crypto data company that does work for several federal agencies, Adam Zarazinski said the order presents the opportunity to provide “new approaches to finance”.

General Counsel for Bitwise Asset Management, a cryptocurrency asset management firm Katherine Dowling said an executive order that provides more legal clarity on government oversight would be “a long term positive for crypto”.

But a financial regulation professor at American University Hilary Allen cautioned against moving too fast to embrace cryptocurrencies. “I think crypto is a place where we should be putting the brakes on this innovation until it’s better understood,” she said. “As crypto becomes more integrated into our financial system it creates vulnerabilities not just to those who are investing in crypto but for everybody who participates in our economy.”

Bitcoin and cryptocurrency related stocks got a boost following Biden’s executive order. The price of Bitcoin was up 9.8 per cent at USD42,211, according to Coindesk. Shares in cryptocurrency exchange Coinbase Global surged 9.3 per cent in midday trading, while online brokerage Robinhood Markets rose 4.5 per cent.