CNA – Asian shares yesterday were headed for the worst month since the onset of the COVID-19 pandemic, while jitters in currency and bond markets persisted over hawkish talk from central banks, worries about global recession and rising geopolitical risk.

MSCI’s broadest index of Asia-Pacific shares outside Japan was largely flat yesterday, as a bounce in Hong Kong and among mainland Chinese bluechips offset declines elsewhere.

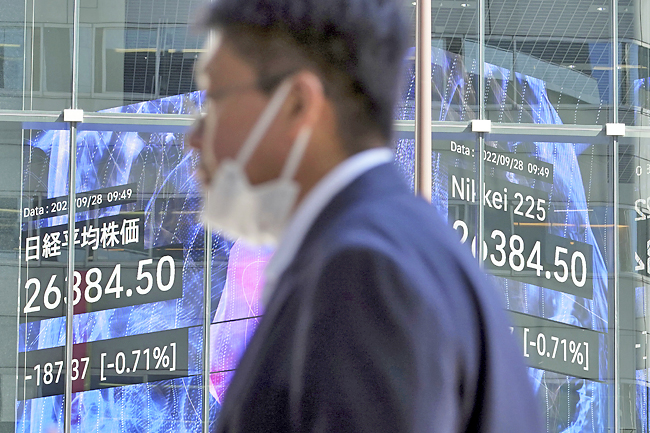

Japan’s Nikkei fell 1.6 per cent.

Relief came from Chinese factory activity data that beat market expectations, with the manufacturing sector returning to growth in September after contracting for two months.

Still, the Asian index was set to record a staggering 12.5 per cent drop for the month, the largest since March 2020 when the COVID-19 pandemic threw financial markets into chaos.

Hong Kong shares were likely heading for their worst quarter since 2001 and Chinese bluechips might also finish in September by recording their biggest quarterly loss since a stock market meltdown in 2015.

“The ‘troubling triad’ of rising rates, slowing growth and strong dollar have all intensified,” said Timothy Moe, chief Asia-Pacific equity strategist at Goldman Sachs.

“We reduce our forecasts further and expect largely flat regional performance over the next two quarters with better returns on a 12-month view.”

In currency markets, traders remained edgy amid risk of intervening from central banks.

The US dollar was little changed against a basket of major currencies at 111.88 yesterday, after retreating 0.9 per cent in the previous day.

However, it is up 2.9 per cent for the month, the best since April. The relentless rise of the dollar has pushed the Japanese yen, Chinese yuan and many emerging market currencies to record lows.

Traders are also wary of possible intervention from China and Japan. Reuters reported that China’s central bank has asked major state-owned banks to be prepared to sell dollars for the local currency in offshore markets.

In Europe, Britain’s gilt market has been roiled along with the pound by government plans for heavy borrowing to finance spending.

Prime Minister Liz Truss said on Thursday she will stick to her plan to reignite economic growth, breaking her silence after nearly a week of financial market chaos.

German Chancellor Olaf Scholz also set out a EUR200 billion (USGD196 billion) “defensive shield”, including a gas price brake and a cut in sales tax for the fuel, to protect companies and households from the impact of soaring energy prices.

That came as Europe braces for a double-digit inflation reading later in the day, as the European Central Bank voiced support for another big interest rate hike. German inflation accelerated to 10.9 per cent this month, far beyond market expectations.

“Increased uncertainty and risks – and higher interest rates – logically see higher volatility in financial markets. Even G7 countries are now trading like emerging markets,” said Jan Lambregts, head of global economics and markets research at Rabobank.

“Indeed, markets now also see a far wider range of possible outcomes when it comes to FX and rate movements.”

US Treasuries stabilised somewhat after a renewed bout of selling on hawkish talks from Federal Reserve officials, with the yield on 10-year bonds up by four basis points in early Asia to 3.7815 per cent.

The two-year Treasury yield also rose a similar amount to 4.2048 per cent.